Role profile: actuary

Actuaries are highly numerate problem solvers and strategic thinkers. They are involved in projects to understand different risks faced by their clients. They estimate future costs that could arise from these risks and advise on strategies to manage them. Throughout their careers, actuaries must:

- continue to develop their skills and knowledge

- maintain their technical competence

- comply with the professional standards for actuaries

Government actuaries work mainly in the Government Actuary’s Department (GAD). Government actuaries provide actuarial advice and analysis to clients in government departments and some public sector organisations.

Actuaries in government are involved in diverse areas of advice including:

- insurance

- investment

- modelling

- quality assurance

- pensions

- social security

This has enabled government actuaries to work in multi-disciplinary teams to produce bespoke and innovative solutions to challenges faced by the public sector.

Typical role responsibilities

Actuaries:

- produce actuarial analysis, advice and assurance for clients

- do complex calculations and modelling

- draft insightful reports

- check and review other people’s work

- communicate effectively

- work with colleagues and clients to scope and produce work in an efficient and timely manner – they concentrate on providing value for money

- provide consistently high levels of service

- manage projects and resources effectively

- motivate and build teams

- look for opportunities to work with others to use their actuarial skills in the public sector

- comply with all professional actuarial standards and continuous professional development requirements

Skills

There are several important skills that actuaries need to be successful in their role.

Find out more about skill level definitions.

You must have proven mathematical skills demonstrated through relevant qualifications or work experience.

You will be expected to demonstrate these skills at different levels depending on the seniority of your role.

Trainee actuary

As a trainee actuary, you must have a ‘working’ skill level.

Actuaries in Band 1 to Band 4

As an actuary at this level, you must have a ‘practitioner’ skill level.

Actuaries in Band 5

As an actuary at this level, you must have an ‘expert’ skill level.

You must be able to demonstrate that you can approach a problem applying logic and creativity.

You will be expected to demonstrate these skills at different levels depending on the seniority of your role.

Trainee actuary

As a trainee actuary, you must have a ‘working’ skill level.

Actuaries in Band 1 to Band 4

As an actuary at this level, you must have a ‘practitioner’ skill level.

Actuaries in Band 5

As an actuary at this level, you must have an ‘expert’ skill level.

You must be able to apply analytical techniques to present solutions to a problem.

You will be expected to demonstrate these skills at different levels depending on the seniority of your role.

Trainee actuary

As a trainee actuary, you must have a ‘working’ skill level.

Actuaries in Band 1 to Band 4

As an actuary at this level, you must have a ‘practitioner’ skill level.

Actuaries in Band 5

As an actuary at this level, you must have an ‘expert’ skill level.

You must have strong verbal and written communication skills. These skills will enable you to share insights with stakeholders.

You will be expected to demonstrate these skills at different levels depending on the seniority of your role.

Trainee actuary

As a trainee actuary, you must have a ‘working’ skill level.

Actuaries in Band 1 to Band 4

As an actuary at this level, you must have a ‘practitioner’ skill level.

Actuaries in Band 5

As an actuary at this level, you must have an ‘expert’ skill level.

You must be able to interpret requirements and present data in a clear and compelling way, using graphical representations and data visualisations.

You will be expected to demonstrate these skills at different levels depending on the seniority of your role.

Trainee actuary

As a trainee actuary, you must have a ‘working’ skill level.

Actuaries in Band 1 to Band 4

As an actuary at this level, you must have a ‘practitioner’ skill level.

Actuaries in Band 5

As an actuary at this level, you must have an ‘expert’ skill level.

You must be a member of the professional body at the relevant level. This level will depend on the seniority of your role.

Trainee actuary

As a trainee actuary, you must have a ‘working’ skill level.

Actuaries in Band 1 to Band 4

As an actuary at this level, you must have an ‘expert’ skill level.

Actuaries in Band 5

As an actuary at this level, you must have an ‘expert’ skill level.

You must be able to demonstrate your knowledge of your specialist area. This includes demonstrating an understanding of the current legislation and government policy.

You will be expected to demonstrate these skills at different levels depending on the seniority of your role.

Trainee actuary

As a trainee actuary, you must have an ‘awareness’ skill level.

Actuaries in Band 1 to Band 4

As an actuary at this level, you must have a ‘practitioner’ skill level.

Actuaries in Band 5

As an actuary at this level, you must have an ‘expert’ skill level.

You must be able to manage client relations and provide effective consultancy.

You will be expected to demonstrate these skills at different levels depending on the seniority of your role.

Trainee actuary

As a trainee actuary, you must have an ‘awareness’ skill level.

Actuaries in Band 1 to Band 4

As an actuary at this level, you must have a ‘practitioner’ skill level.

Actuaries in Band 5

As an actuary at this level, you must have an ‘expert’ skill level.

Sample career path

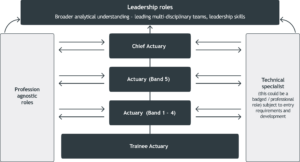

The actuary career path shows some of the common entry and exit points for the role. It also shows the typical skill levels needed.

You can enter an actuarial role from any other profession. You can also exit the role to join another profession.

The diagram shows a potential career path. It shows that you can enter or leave a role from a wide range of backgrounds and experience levels. For example, you could become an actuary by developing your skills in a trainee role. You could continue to move up the levels in the career path by taking on more senior actuarial roles. Or you could develop your skills by working in a technical specialist role in an analytical or digital profession. You could also develop the necessary skills by working in a profession agnostic role outside of these professions.

A role that could be done by any person with the relevant skills or experience from any profession.

This could be a ‘badged’ or professional role that is subject to entry requirements and development.

Beyond the chief actuary role, you could go into more senior leadership roles. These roles require broader analytical understanding, and the ability to lead multi-disciplinary teams.